LEM

Financial Management Ltd.

LEM MANAGEMENT OFFERS ITS

CLIENTS INNOVATIVE PRODUCTS

AND FINANCIAL OPPORTUNITIES

THAT DEMONSTRATE COMPETITIVE

INVESTMENT PERFORMANCE

LEM Management LTD.

We consider ourselves as the primary link between

global houses seeking to raise money in Israel and local

investors aiming to pursue global exposure.

LEM Management has established business partnerships with selected leading international investment houses, with exclusive representation rights in Israel

LEM Management offers its clients innovative products and financial opportunities that demonstrate competitive investment performance.

LEM Management offers its clients

innovative products and financial

opportunities that demonstrate

competitive investment performance.

Providing tier one products in fixed income, equity and alternative asset classes; in Global, European and US markets, as well as emerging markets and markets of specific countries.

LEM Management has established

business partnerships with selected leading international investment

houses, with exclusive representation

rights in Israel

LEM Management has established

business partnerships with a selected leading international investment houses, with exclusive

representation rights in Israel

WE ALWAYS WELCOME NEW OPPORTUNITIES TO EXPAND OUR REACH WITH THE INTERNATIONAL INVESTMENT COMMUNITIES

Our main goal is to establish long-term relationships for our local investors and

the global investment houses and financial institutions we represent.

Our clients include; provident and pension funds, Banks, family offices,

corporate clients and HNW Individuals.

WHO ARE WE

Saar Levi

Chief Executive Officer

Read more

Saar Levi has over 20 years’ experience in

trading and sales activities in global

financial markets. Saar spent the majority

of his career in New York, working for

leading financial institutions such as

Lehman Brothers, Barclays Capital and Intesa Sanpaolo/Banca IMI Securities Corp,

in various executive positions and responsibilities.

He has initiated and ran Lehman

proprietary ETF strategies, as well as, establishing and managing Banca IMI US

ETF business. Later, Saar was recruited as

the CEO of a global exchange located in Luxembourg. Saar returned to Israel in 2011

and established LEM Management LTD,

with the goal of bringing together local

money managers and expert global fund managers.

Tzachi Ashkenazi

VP Sales & Marketing

Read more

Tzachi Ashkenazi has 14 years of experience managing sales and marketing strategies for institutional clients in Israel’s capital markets. Tzachi was previously the head of business development at IBI investment house, Tachlit ETN’s, and the head of brokerage at Migdal Capital Markets, a Tel-Aviv stock exchange member. Tzachi holds investment advisor license by ISA

Shlomi Elkayam

VP Business Development

Read more

Shlomi Elkayam has been trading capital

markets in New York and Israel for over 25

years, previously as the head of trading at Clarity Capital and before that as the head of international brokerage at Poalim Sahar,

a member of the Tel Aviv Stock Exchange,

serving the firm’s institutional clients.

Shlomi earned a bachelor’s degree in arts

from Haifa University and a master’s degree

in business administration from the University

of New Haven in Connecticut. He holds Series 7,55,24, and 3 Trader license, and has

Investment advisor license by ISA.

Joseph Sefi Samuelof

Institutional Sale Side Analyst

Read more

Joseph Sefi Samueloff is an investment management professional, specializing in providing financial solutions to institutional investors and has extensive knowledge and experience with diverse financing investment strategies, assets and instruments.He held key positions as a capital market senior analyst, in renowned companies, such as American Express, EJ Sterling, Migdal Capital Markets, HedgeStone Group. He holds an MBA Degree in Finance, from the City University of New York / Baruch College and he also holds an MA Degree in Organizational Consultation, from the Tel Aviv University in Israel.He is also C.F.A (Chartered Financial Analyst) level 1 candidate and has also extensive familiarity with the United States F.I.N.R.A series 7 licence as well as with the Israeli Securities Authority investment portfolio management license.

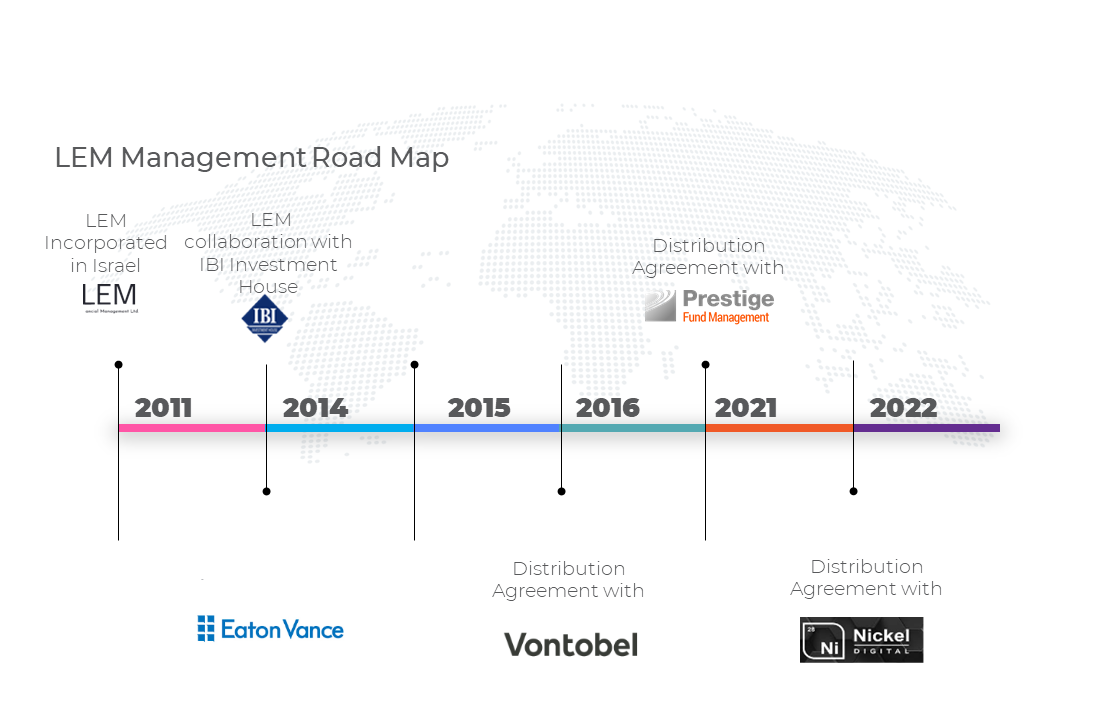

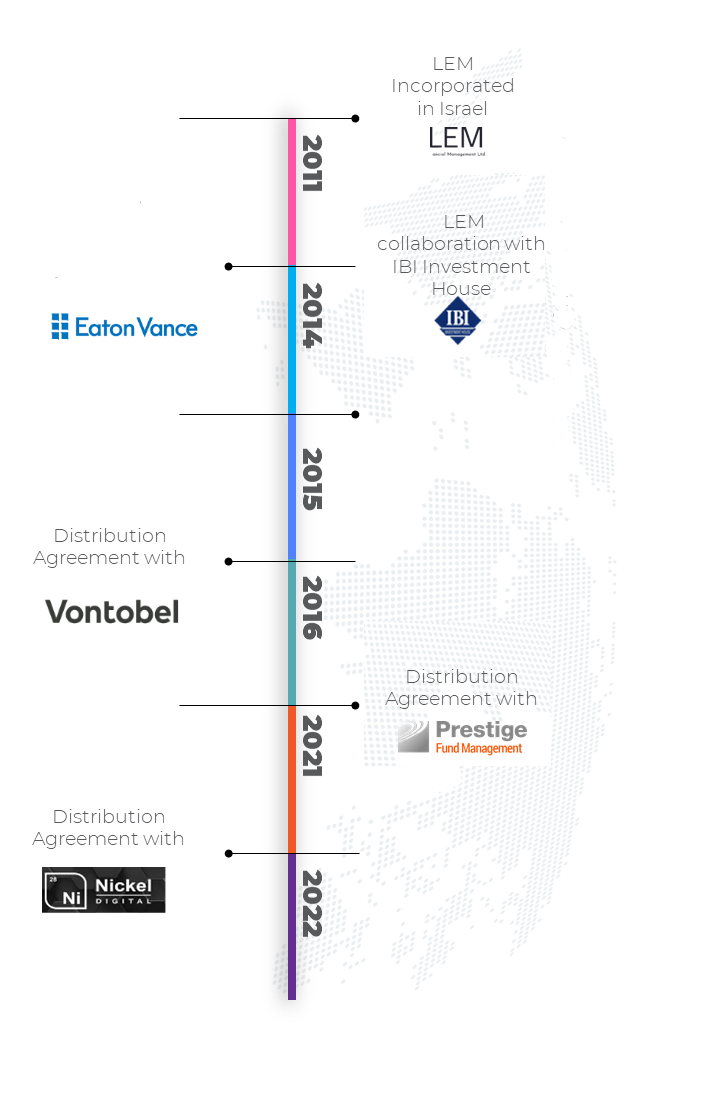

LEM FINANCIAL MANAGEMENT ROAD MAP

OUR COMMITMENT

Our objective is to offer our clients innovative products and financial

opportunities that demonstrate competitive investment performance.

To earn our clients’ loyalty by providing tier one Investments products, in all asset

classes, to investors seeking global exposure with a special attention to Alfa

generating asset manager as well as tax efficiency;

To distribute and open the Israeli market to global funds managers seeking to

fundraise investment into their funds.s

We are committed to ensure that the entire process is carried out in the up-most

professional manner and under the Israeli regulation.

LEM Financial Management is dedicated to being a long-term valued partner

throughout the entire investment lifecycle.

OUR CLIENTS

LEM Financial Management LTD.

distributes third party

Global Investment Houses and Funds to Israeli

institutions, corporations and HNW individuals.

OUR CLIENTS INCLUDE:

Provident Funds

Pension Funds

Banks

Family Offices

Corporate Investors

High Net Worth individuals

LEM Financial Management services are rendered solely to

clients who are “Eligible Clients” and “Qualified Clients” as defined in the First Schedule of the Securities Law, and in the First Schedule of the the Advisory Law.

LEM Management does not distribute, promote or market its financial products in Israel in a manner that would constitute “an offer to the public” under the Securities Law or the Trust Law

OUR STRATEGIC AFFILIATES:

Nickel Digital is a London-based firm founded in 2018 that is authorized and regulated by the FCA and provides a variety of digital asset strategy solutions to institutional investors.

Nickel Digital is Europe’s leading award-winning digital asset manager, offering traditional investors a gateway into the digital assets market across a wide range of risk profiles.

The firm employs a low-latency algorithmic trading system, pursuing a variety of arbitrage strategies in both spot and derivative markets that capitalize on volatility, price dislocations, and arbitrage opportunities provided by cryptocurrency markets. The market-neutral Digital Asset Arbitrage fund, Nickel’s flagship fund, has won the HFM EuroHedge 2020 Emerging Manager Awards and the HFM 2021 Quant Performance Award.

Prestige Founded in 2007, the Prestige group manages

approximately USD 1 billion in assets

Global presence with offices in London (UK), Cambridge (UK),

Norfolk (UK), Malta, Luxembourg, Cayman Islands and India with over 120 professional team members.

* Highly committed to provide innovative investment solutions that are sustainable and have a positive social impact.

Reputation has been built upon our expertise across the credit spectrum and particularly in private debt, real assets and alternative lending strategies

Reputation has been built upon our expertise across the credit spectrum and particularly in private debt, real assets and alternative lending strategies

Squarely focused on producing consistent and positive risk-adjusted investment returns with limited volatility

Squarely focused on producing consistent and positive risk-adjusted investment returns with limited volatility

All Prestige Funds have low correlation to traditional asset

All Prestige Funds have low correlation to traditional asset

classes

is a London-based firm founded in 2018 that is authorized and regulated by the FCA and provides a variety of digital asset strategy solutions to institutional investors.

Nickel Digital is Europe’s leading award-winning digital asset manager, offering traditional investors a gateway into the digital assets market across a wide range of risk profiles.

The firm employs a low-latency algorithmic trading system, pursuing a variety of arbitrage strategies in both spot and derivative markets that capitalize on volatility, price dislocations, and arbitrage opportunities provided by cryptocurrency markets. The market-neutral Digital Asset Arbitrage fund, Nickel’s flagship fund, has won the HFM EuroHedge 2020 Emerging Manager Awards and the HFM 2021 Quant Performance Award.

Prestige Founded in 2007, the Prestige group manages

approximately USD 1 billion in assets

Global presence with offices in London (UK), Cambridge (UK),

Norfolk (UK), Malta, Luxembourg, Cayman Islands and India with over 120 professional team members.

* Highly committed to provide innovative investment solutions that are sustainable and have a positive social impact.

Reputation has been built upon our expertise across the credit spectrum and particularly in private debt, real assets and alternative lending strategies

Reputation has been built upon our expertise across the credit spectrum and particularly in private debt, real assets and alternative lending strategies

Squarely focused on producing consistent and positive risk-adjusted investment returns with limited volatility

Squarely focused on producing consistent and positive risk-adjusted investment returns with limited volatility

All Prestige Funds have low correlation to traditional asset

All Prestige Funds have low correlation to traditional asset

classes

Prestige Founded in 2007, the Prestige group manages

approximately USD 1 billion in assets

Global presence with offices in London (UK), Cambridge (UK),

Norfolk (UK), Malta, Luxembourg, Cayman Islands and India with over 120 professional team members.

* Highly committed to provide innovative investment solutions that are sustainable and have a positive social impact.

classes

www.prestigefunds.com